3D Secure (3DS) Card Payments Authorization Enhancement

The growth of e-commerce necessitates robust security solutions like 3D Secure to secure against Card-not-present (CNP) fraud.

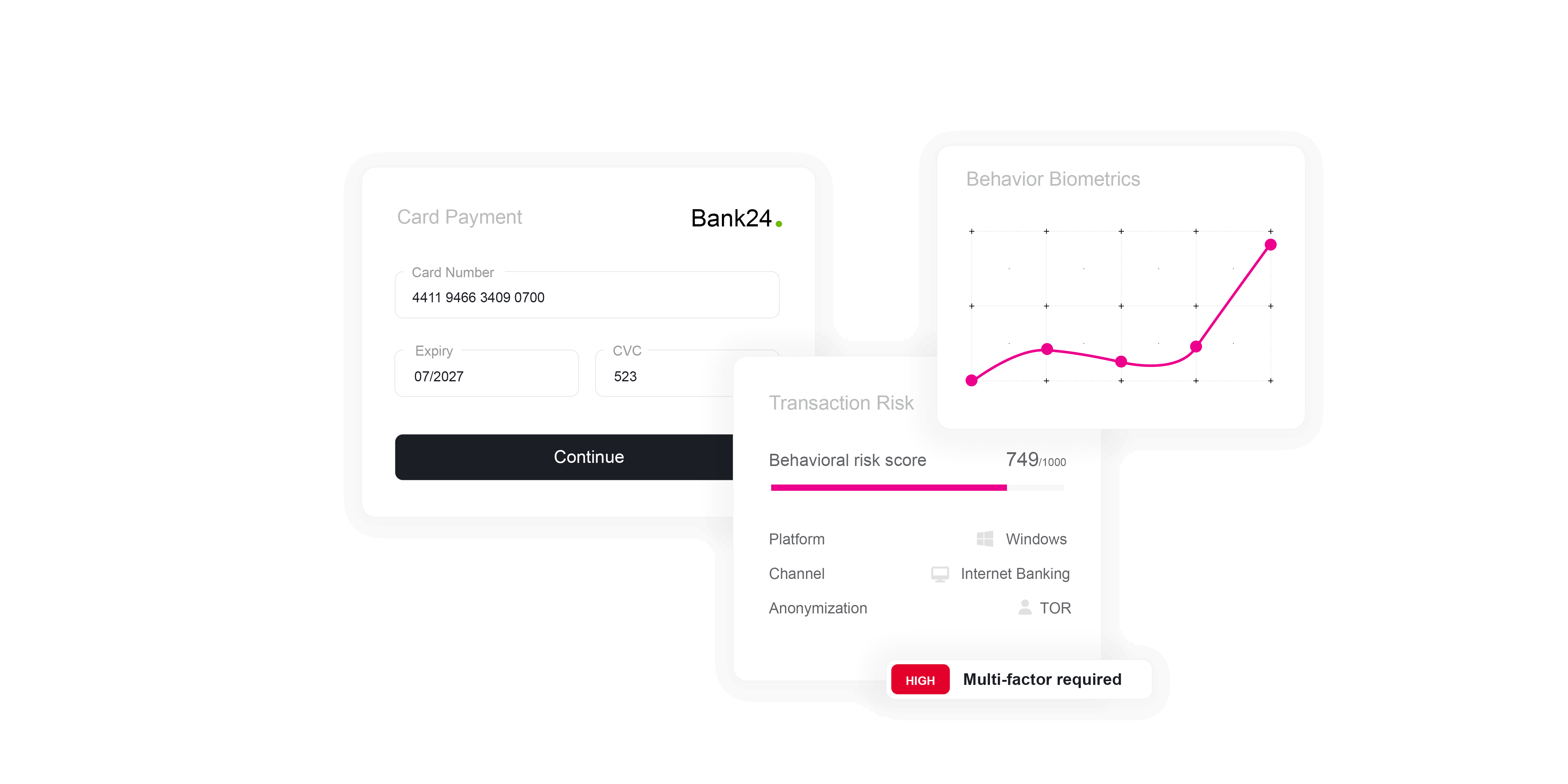

Developed as an additional layer of security for online credit cards through the introduction of multi-factor authorization (MFA), 3D Secure often brings friction and a high abandonment rate. ThreatMark provides an ultimate tool to decide whether there is a reason for MFA, improving customer experience without jeopardizing detection capabilities.

Enhance your 3D Secure

Card Payments Authorization and reduce friction.

Involving two steps to verify a credit cardholder’s identity, 3D Secure introduced a secure authentication process for payment gateways following the boom in online transaction. Despite its effectiveness in preventing fraud, this process often results in additional steps and delays, leading to customer frustration and a higher cart abandonment rate during online transactions.

ThreatMark’s behavioral intelligence reduces the reliance on these additional steps. By analyzing device reputation and subtle behavior markers that can successfully identify non-human behavior (scripted access) or devices compromised by financial malware.

Frequently Asked Questions

-

What other enhancements does ThreatMark offer the 3D Secure process?

Beyond successfully identify non-human behavior (scripted access) or devices compromised by financial malware, ThreatMark also identifies impostors’ behavior based on the keystroke’s dynamics, mouse movements, and mobile behavioral biometry.

-

Is ThreatMark a replacement of 3D Secure?

In short, no. ThreatMark offers an additional layer of security to online transaction and is not a replacement to adopted payment authorization methods.

-

How does this improve customer experience?

ThreatMark’s data enrichment ensures that legitimate payers are authenticated without the hassle of second authentication, mitigating fraudulent activity at the payment gateway stage. This unique approach makes ThreatMark a valuable tool for banks to increase their customers’ user experience, leaving fraudsters at bay.

-

Transactional Risk Analysis

To determine a low-level of risk, banks need to analyze various factors of a transaction in real time. ThreatMark provides a comprehensive solution that considers all necessary factors to avoid unnecessary MFA whenever possible.

Learn more

-

Strong & Invisible Authentication

Strong and invisible authentication crucially balances advanced security with a seamless customer experience. Utilizing technologies like behavioral biometrics and behavioral analytics, authenticating users subtly and effectively can minimize the risk of fraud and unauthorized access.

Learn more

-

Payment Transaction Authorization

Traditional transaction monitoring systems often analyze only a limited amount of payment-related data, leading to false positives where even small or insignificant payments trigger an alert because they don't align with the client's previous spending patterns.

Learn more

Traditional fraud prevention tools are no longer enough.

Speak with a ThreatMark Fraud Fighter to find out more about our comprehensive approach to fraud disruption.