Smart Insights

Data and smart signals are crucial to preventing fraud.

Quality data ensures ThreatMark accurately learns and recognizes normal customer behaviors, which is vital for distinguishing between legitimate activities and potential fraud. ThreatMark’s smart signals, derived from sophisticated algorithms, are essential for pinpointing precise patterns indicative of fraudulent behavior. This combination enhances ThreatMark’s effectiveness, reducing false positives and improving the detection of sophisticated fraud schemes, thereby bolstering overall security and trust in financial transactions.

Increased detection accuracy with fewer false positives.

Detecting fraud efficiently and accurately is a huge concern for financial institutions. If they get the detections wrong, the burden on fraud analysists can be tremendous. Traditional fraud detection methods often struggle with high volumes of false positives, where legitimate transactions are incorrectly flagged as fraudulent. This not only weighs down the institution with increased operational workload but also leads to customer dissatisfaction due to unnecessary transaction delays or denials.

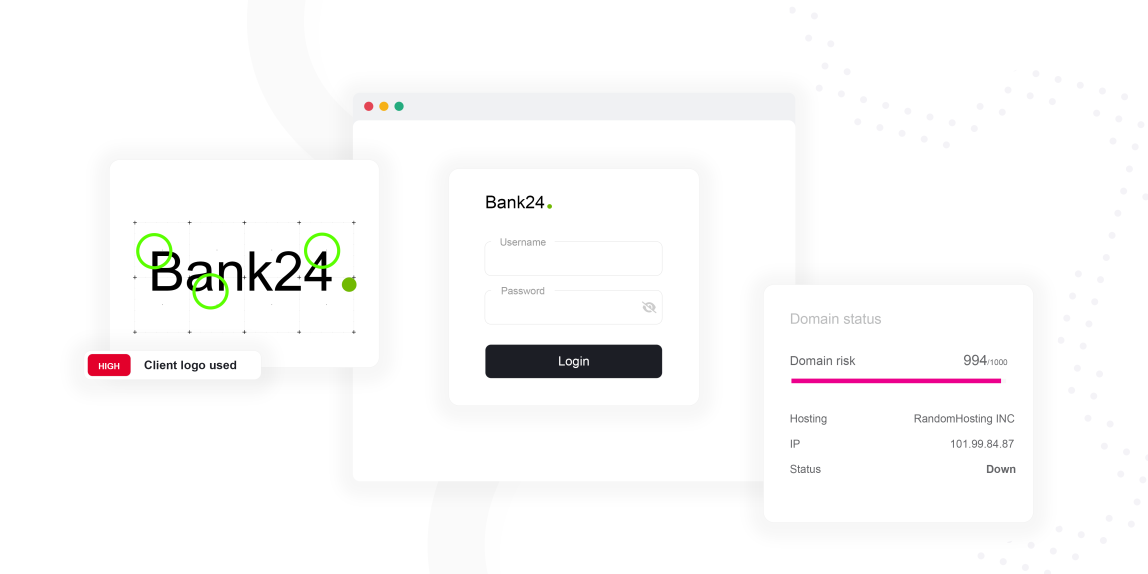

Smart signals, as part of a behavioral intelligence platform, address this issue by providing more precise and nuanced indicators of fraud. By analyzing complex patterns and correlations in data that are not immediately apparent, these signals significantly reduce false positives. The signals can be gathered from a variety of perspectives, from environmental cues such as geolocation or time of day, to device intelligence, to user behaviors—including navigation behavior and biometric behavior. This results in a more streamlined detection process, enhancing customer experience by minimizing unwarranted disruptions to legitimate transactions. Simultaneously, it allows financial institutions to focus their resources more effectively on investigating truly suspicious activities, thereby improving overall fraud detection efficiency.

Improving fraud detection efficiency.

Empower your financial institution with Smart Insights.

-

Environmental Cues

The environment in which a user is operating can be used to evaluate intent. These cues can include geolocation, time zone on the device, the internet service provider, the language of the operating system, and more.

-

Device Intelligence

The device that is in use during a session can provide valuable insight and aid in detecting fraud. This intelligence can include the device identification, which helps determine if a device has been used with nefarious intent in the past.

-

Behavioral Intelligence

Behavioral intelligence is includes both user behaviors as the interact with the digital platform and behavioral biometrics, which is the user’s digital fingerprint. User behavior can include things like their typical time of access and how they navigate the platfrom. Behavioral biometrics is a unique fingerprint that is developed by analyzing things like how the user interacts with the device.

Revolutionizing fraud prevention.

Our Behavioral Intelligence Platform is the world’s first full-stack fraud prevention platform built on behavior intelligence. Combining transaction risk analysis, threat detection, and user behavior profiling capabilities in one integrated platform.

learn More

Minimize fraud and credit risks

Apply AI-based anomaly detection software to identify advanced fraud threats, minimize fraud that employ social engineering, phishing, malware, and zero-day attacks.

Distinguish legitimate users

Verify user identity, expose fraudulent signups and prevent other malicious online activities with real time monitoring.

Strike a balance

Add a layer of invisible protection to existing authentication systems, protecting users without the hassle and cost of two-factor authentication.

Enhanced Customer Experience

Improve customer experience by minimizing unnecessary interruptions and provide a seamless and secure banking experience.

Traditional fraud prevention tools are no longer enough.

Speak with a ThreatMark Fraud Fighter to find out more about our comprehensive approach to fraud disruption.