Investment Scams

Investment scams lure victims with the allure of high returns on nonexistent opportunities.

These schemes involve tricking individuals into moving their money to fictitious funds or investing in fake ventures. The fraudster typically entices the target with the promise of significant gains, urging them to act quickly. Such scammers frequently employ tactics like cold-calling to identify and pressure their targets, emphasizing the urgency and exclusivity of the investment chance. Despite the relatively fewer instances compared to other Authorized Push Payment (APP) scams, investment scams account for substantial financial losses among victims.

Talk to a fraud fighter

The impact of investment fraud.

-

40%year-on-year rise of reported incidents of investment scams.

-

10Bdollar annual global loss due to investment scams.

-

70%of reported victims are individuals aged 65 and above.

Shield customers from investment scams.

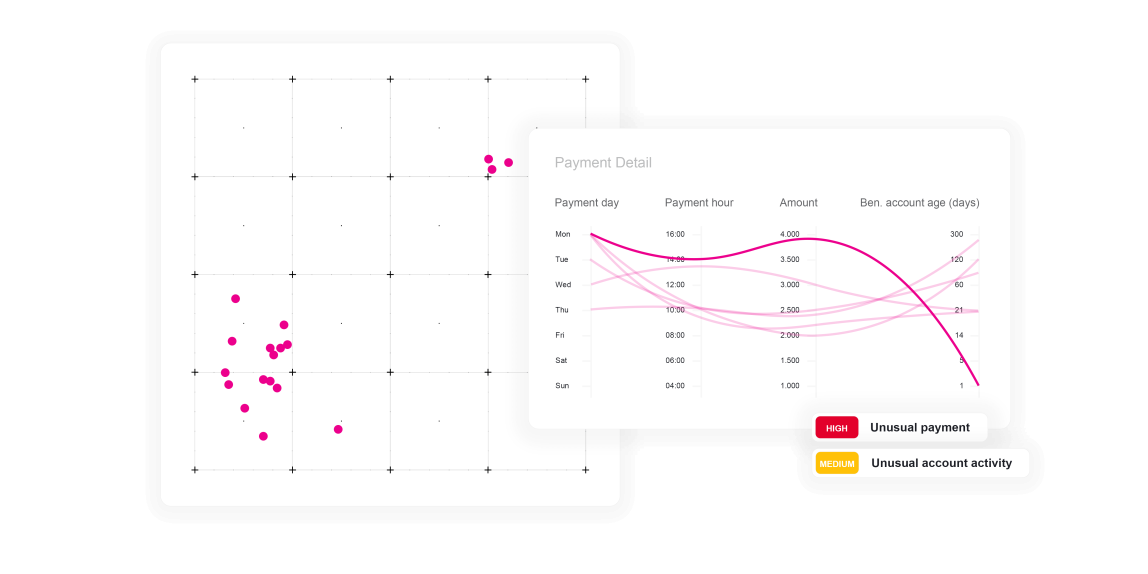

Threatmark’s behavioral intelligence is key in aiding financial institutions in combating investment scams by analyzing and understanding each customer’s unique transaction patterns. It detects irregularities, such as sudden significant investments or transfers to unknown accounts, which are atypical for the user. These anomalies could indicate a scam, especially if they align with the characteristics of known investment fraud schemes. The system continuously monitors transactions, quickly identifying suspicious activities in real time. This proactive approach allows institutions to intervene before the customer incurs financial losses.

ThreatMark deepens the institution’s analytical capabilities to foresee and prevent investment scams. Analyzing transactional data and customer interaction patterns with new or suspicious accounts helps pinpoint individuals who might be at higher risk of falling for such scams. Advanced analytics enable institutions to refine their monitoring, enhancing their ability to detect and respond to the evolving tactics of investment fraudsters. This strategic use of artificial intelligence significantly bolsters the FI’s defense against financial scams, safeguarding customers’ assets and maintaining the integrity of the banking system.

Mitigating investment fraud.

Understanding investment scams.

-

Login Biometry Anomaly

The keystroke dynamics observed during the login process differ from the previously recorded ones in this client's history. Such a variance could imply that an account is accessed by a different user, possibly another legitimate user or someone with access to the credentials. Alternatively, it might signal a malicious scenario where an attacker has illicitly obtained the credentials and is attempting unauthorized access to the victim's account.

-

Payment Tampering

Payment tampering fraud occurs when an attacker interferes with the payment process to redirect funds, change payment details, or manipulate transaction data, aiming to benefit themselves or a third party. By analyzing discrepancies between payment details typed in the interface and data registered in the backend, ThreatMark can detect modifications in payment data.

-

Abnormal Payment

The payment amount, time of day or day of the month of transfer, and the beneficiary can all be analyzed for risk to uncover if the payment is abnormal. Looking at the context of the payment in combination with other risk indicators can prevent fraudulent payments.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.