Heartbreak and Empty Wallets: How Can Banks Protect Their Customers From Romance Scams?

Leaving their victims without money and their trust shattered, romance scams are among the most financially and psychologically devastating types of fraud.

Unfortunately, this proven fraud strategy has been increasing in both number and sophistication. Let’s examine the nitty-gritty of online dating scams and how financial institutions can protect their customers from broken hearts and empty bank accounts.

Romance fraud—also known as romance scams or online dating scams—is a fraud scheme in which the scammer uses a false identity to arouse the romantic interest of their victim. The fraudulent suitor eventually drains their victim of money or collects enough sensitive information to steal their identity or start (s)extorting the victim.

Why scammers bet on love

Romance scams are not necessarily linked to the digital age and internet penetration. Evidence of fraudulent suitors dates back to the 16th century. Back then, scammers used letters instead of online communication, but the storytelling hasn’t changed much. The Spanish prisoner scam was particularly popular, involving a fraudster claiming to be a rich person trapped in a prison in Spain. He proposed that if the victim sent money for his escape, he would repay them a fortune and arrange a marriage with his beautiful daughter, an heiress.

Although the basic tactics of romance scammers have not changed much (more below), the internet, the interconnectivity of the global population, and the proliferation of online dating sites and apps make romance fraud much easier. As a result, online dating scams are on the rise in many parts of the world.

Romance scams data: the US, the UK, and others

The increase is stark just by looking at a timeline of romance fraud in the United States. Here, the losses reported to the Federal Trade Commission (FTC) amounted to $201 million in 2019, $304 million in 2020, $547 million in 2021, and $1.3 billion in 2022. This means that from 2019 to 2022, the (reported!) losses from romance scams increased by approximately 547%.

In 2023, the surge finally seemed to subside. Nevertheless, over 63,000 romance scams were reported with total damages of $1.18 billion and median losses per person of $2,000, representing the highest reported losses for any form of imposter scam. In 2024 so far, the losses are already as high as $240 million. This is further supported by Norton data showing that online dating fraud has skyrocketed 72% in the past year, with 27% of Americans who use dating apps saying they have been targeted. Nearly a third of them have fallen victim to “catfishing” through fake personas.

In the UK, the trend is similar and equally worrying. According to UK Finance, online dating scams cost victims £31.3 million in 2022, £13.5 million more than in 2020. In 2023, a further 17% increase led to an all-time high of £36.5 million in damages. The total number of romance scams also increased by 31% in 2023, up 200% from 2020. Around a third of Brits (31%) have been targeted by an internet dating scammer, according to research by Santander UK.

Romance fraud is by far the biggest challenge in India. According to Statista, about 66% of the adult population in the country has fallen victim to online dating scams as of January 2023. Other countries, such as Australia, New Zealand, and France, also report worrying trends.

Anatomy of an online dating scam

With trust being the main key to successful romance fraud, these scams usually have a fairly long timeframe, lasting 6–8 months on average. What does the timeline of a romance scam look like?

Phase 1: Contact

Most romance scams start online: on dating sites/apps (Tinder, Hinge, OkCupid, Match.com, Bumble, and others), social networks (Instagram, Facebook), or via email or messaging apps. According to the Federal Trade Commission (FTC), up to 40% of Americans who said they lost money to a romance scam last year reported the contact started on social media; 19% said it started on a website or app. Communication then usually moves quickly to messaging apps only.

The false identity created by fraudsters varies, of course, depending on the victim they target. If the victim is a man, the fake profile usually imitates a physically attractive young woman. If the victim is a woman, the catfishing profile usually presents a physically attractive man, but often older and claiming a good financial position (business owner/executive, army officer, etc.).

Phase 2: Grooming

Once contact is made, scammers try to establish a sense of special emotional connection and trust in the victim often very rapidly. To do this, they usually use proven psychological tactics, targeting victims suffering from loneliness, romanticizing relationships, and showing signs of dependency. Sexual desire is often exploited as well, especially in male victims. In short, fraudulent suitors capitalize on the weaknesses of their targets.

A typical sign of an online dating swindler is the inability to meet physically—whether because of work (they usually claim they’re working on an oil rig, on an overseas ship, abroad) or other circumstances (they’re being held captive, etc.).

At the ThreatMark Fraud Summit, Zuzana Juráneková, an expert in online fraud psychology, said that among the relatively trivial, but very effective micro tactics of romance fraudsters are very basic questions, e.g. about the victim’s favorite color. If the victim likes blue, the scammer will start sending blue hearts in the chat. Adapting such tactics aims to suppress the victim’s rational thinking and, eventually, lure money.

Phase 3: The money request

After building a seemingly intimate relationship with the victim, the request for money comes. The excuses scammers use vary. The FTC has compiled a list of the most common ones based on reported scams from 2022:

- I or someone close to me is sick, hurt, or in jail (24%)

- I can teach you how to invest (a pig butchering scam) (18%)

- I am in the military far away (18 %)

- I need help with an important delivery (18 %)

The offer of investment is one of the common elements of a romance scam. It’s called a pig butchering scam. As of October 2023, around 12% of Americans using dating apps had fallen victim to pig butchering scams.

After an initial request for a small investment, the scammer pushes the victim into making increasingly larger financial contributions. The victim, under the impression of the initial “success” of the investment, agrees. Once the victim has invested most of their money, the “slaughter” comes: the investment turns out to be a fake, and the scammer disappears. At this point, victims usually have only a very slim chance of retrieving their money.

It is important to note that due to the high level of trust the victim has in the scammer and the long duration of the scam, romance scams—especially those associated with pig butchering—are among the most financially devastating. For example, UK Finance data says that online dating scams have an average of nearly ten scam payments per case. It’s the highest of all scam types, highlighting evidence that the individual is often convinced to make multiple payments to the criminal over a longer period.

Phase 4: Becoming a money mule

Although it might seem that the moment the victim is financially drained, he or she loses appeal to the scammer, this is often not the case. Some instances show that the scammers then force the victim to participate in the scam again, turning them into money mules.

A person can simultaneously be a romance scam victim and a co-offending money mule as they might recognize that they’re participating in a crime but deny that the relationship is part of the scam. Hanna Silva Cunha of the University of Newcastle, Australia, notes that a minority of victims are subsequently subjected to sexual abuse through cybersex.

Phase 5: The aftermath

The consequences for victims of romance fraud go beyond mere financial losses. Victims of romance scammers often suffer long-term psychological consequences. These include embarrassment, shame, stress, anxiety, depression, fear, or even suicidal thoughts. Suicide or death as a result of a romance scam has been documented in the media on several occasions (see the cases of the Welsh man, the elderly Tennessee man, or the yet unexplained death of a woman from Illinois).

This victim’s confession to the CBS News Texas I-Team is telling: “It wasn’t the money. It’s the shame. You think, ‘How could I be so stupid?’ I tried to kill myself because I felt like I couldn’t live knowing that I had participated in something like that.”

Here is a confession of a 69-year-old widow to Business Insider: “Losing the money—that was devastating. But losing that love and the thought of that family that we had? That’s what crushed me.”

The words above document why romance scams are so harmful. Most of the victims are genuinely convinced that they are in a serious relationship with the scammer and they believe in their shared love until the last moment. A study done by Monica Whitty and Tom Buchanan found the loss of a love relationship was sometimes even more upsetting than the loss of money.

How AI affects online dating scams

Given that internet dating scams often have a devastating effect on human lives, the question of what the advent of generative AI will do to this type of fraud is pertinent. The answer is worrying, as AI gives romance fraudsters a very effective weapon to deceive their victims even faster and more effectively. AI-driven romance scams are much harder for unsuspecting victims to spot, as McAfee’s research demonstrates: a full 69% of adults globally are unable to recognize an AI-generated love letter.

Deepfakes—whether voice or facial—cause further worries to the fraud fighters. The first signs of their impact are already clearly visible in India. According to a report by Tenable, love scams are a worrying phenomenon in online dating. In 2023 alone, as many as 43% of Indians fell victim to AI voice scams while seeking love online. Additionally, 83% of those who have been targeted suffered financial losses.

Cases of people who have been tricked by facial deepfakes are also proliferating. One news story, for example, reports a woman who paid half a million dollars to a swindler using a deepfake to pose as Hollywood actor Mark Ruffalo.

Read more about AI-driven fraud

How to prevent romance scams

The best way to eradicate the damaging effects of romance scams is to prevent them from happening in the first place. Educating the public about the existence of romance scammers and their common tactics is essential. Of course, dating apps and social media also have a large part of the responsibility to detect and remove fake profiles and implement reporting tools.

Interesting are the voluntary activities that were presented at the ThreatMark Fraud Summit 2024. For example, a group of female volunteers purposefully attracts online dating scammers, keeping them busy but ineffective, and thus helping uncover them. Thanks to their intensive activity, the group has reported 1,264 accounts (767 in the Czech Republic and 497 abroad) since July 2023.

However, until the “suitor” asks for money, it is difficult to convict him of malicious intentions. Banks and PSPs thus play a big role in detecting internet dating scams. Data from the FTC shows that in 14% of all romance scam cases, payment is made through a bank wire transfer or payment. Simultaneously, bank wire transfers and payments account for a total of 27% of the financial losses (cryptocurrencies come in first with 34%).

Like other social engineering cases, online dating scams and pig butchering scams are difficult for financial institutions to detect. Their long timelines and repeated payments, mostly from legitimate accounts by legitimate users, often make traditional fraud-detection systems and measures fall short.

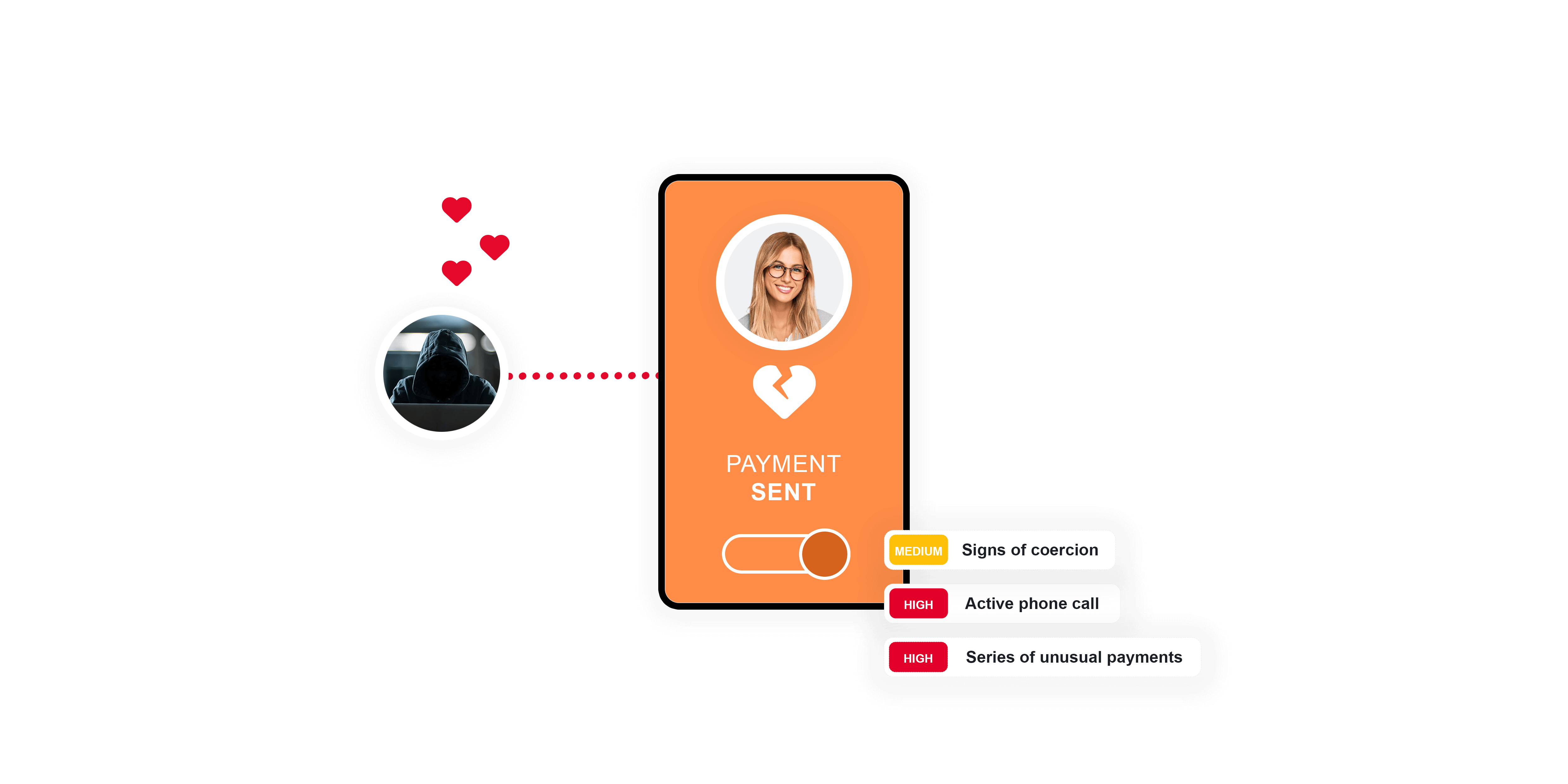

Combating romance scams with behavioral intelligence

As with other APP scam cases, behavioral intelligence has proven extremely helpful and effective in diminishing romance scams. ThreatMark’s Behavioral Intelligence Platform enhances a holistic approach to romance fraud prevention by leveraging a wide range of different data, in real-time.

When a user acts under the influence of a fraudster, their behavior changes. By combining transaction risk analysis, threat detection, and user behavior profiling capabilities, ThreatMark’s Behavioral Intelligence Platform can spot even the slightest deviation from the norm—whether it’s an unusual transaction amount or frequency, a new payee, an active phone call, active remote access tools, or other risk factors.