Credential Theft

The threat of credential theft poses a significant challenge to financial institutions and their customers.

As the adoption of digital banking platforms increases, the tactics employed by fraudsters seeking unauthorized access to customer accounts get more sophisticated. The illicit acquisition of usernames, passwords, and other authentication data enables malicious actors to compromise online accounts and financial transactions.

The impact of attacks resulting from the theft is substantial, impacting not only the financial well-being of the customers but also eroding their trust in the financial institution and damaging its reputation.

Talk to a fraud fighter

The impact of credential theft.

-

25%annual increase in digital fraud cases from credential theft.

-

50Bdollar annual global losses from credential theft fraud, encompassing direct theft and expenses for detection, remediation, and compliance.

-

35%of reported credential theft victims are young adults between the ages of 18 and 29.

Robust protection against credential theft.

ThreatMark’s Cyber Fraud Fusion Center and behavioral intelligence platform together form a robust defense against credential theft at financial institutions.

The Cyber Fraud Fusion Center team plays a critical role in the early detection of phishing attacks by continuously scanning for and identifying fraudulent websites and suspicious online activities. This proactive surveillance enables them to quickly respond to threats targeting customers, significantly reducing the lifespan and impact of phishing sites. By promptly alerting financial institutions to these threats and advising on how to recognize scams, the team helps prevent the disclosure of sensitive information.

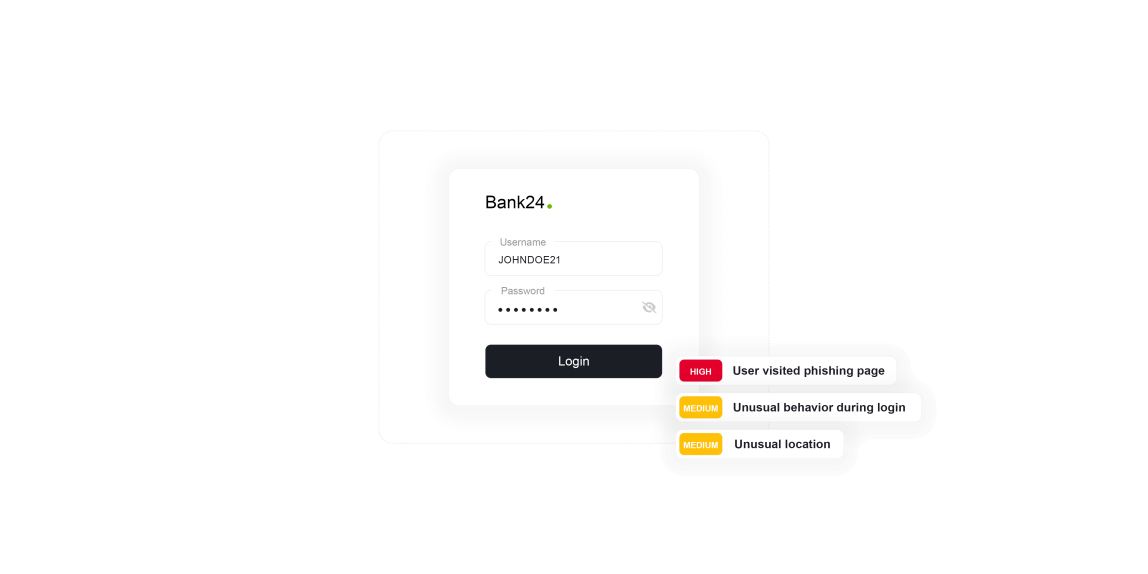

Behavioral intelligence complements this by analyzing customer transaction patterns and detecting anomalies that may indicate unauthorized account access. For instance, if a customer’s account shows unusual login locations or uncharacteristic transactions, the system can flag these activities for further investigation. This combination of constant internet monitoring and behavioral analysis not only aids in preventing financial losses due to credential theft but also reinforces customer trust and the financial institution’s reputation for stringent security measures.

Preventing credential theft.

Understanding credential theft.

-

Phishing Site Detection

Criminals employ more advanced techniques to trick users into disclosing their login credentials. The fraudulent pages they construct are highly automated and remarkably convincing. ThreatMark's behavioral intelligence and early threat detection recognize common risk factors, such as when a user accesses a secured site with an HTTP referer linked to a recognized phishing site, identifying potential phishing victims and enhancing detection measures.

Learn More

-

Mobile Biometry Anomaly

Mobile behavioral biometry is continuous user verification. Each user has a unique pattern of how the device is held and operated, along with patterns of touch gestures. Based on these patterns, ThreatMark can identify if current visit data matches previously observed patterns obtained during previous visits.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.