How Behavioral Intelligence is Helping Combat Investment Scams

Investment scams rank as the most widespread form of APP fraud worldwide, causing significant financial loss and affecting more individuals every year.

Why do these scams remain so notoriously prevalent, and what measures can we take against them? Let’s explore the data, tactics, and prevention strategies surrounding investment fraud in detail.

When it comes to money lost, investment fraud is undeniably the leading type of fraud globally. The data speaks for itself: In 2023, investment scams accounted for over $4.6 billion in reported losses in the US and A$292 million in Australia. During the first half 2023 alone, investment scams caused £57.2 million in damage in the UK, representing the largest share of all APP scam categories.

How to recognize an investment scam

Investment scams can vary in their strategies and tactics for engaging, convincing, and ultimately defrauding individuals. From Ponzi (or pyramid) schemes to exploiting trendy topics like cryptocurrency and AI or employing sophisticated social engineering techniques to methodically groom victims into making larger financial investments, scammers are continuously adapting their methods creatively.

While the pretext, channels, and overall tactics may vary, investment scams share several core characteristics:

- Promises of exceptionally high returns with minimum risk. To lure as many victims as possible, online scams usually promise unreasonably high and “guaranteed” profits. As a rule, if it sounds too good to be true, it probably is.

- Demands to enlist family and friends. Many investment scams leverage the existing trust within a collective of people, be it a family, a group of friends, or colleagues. If the scheme motivates you to recruit other investors and promises bonuses for that, be aware. It is a typical modus operandi of a pyramid scheme.

- “Crypto” involved. Scammers like to use cryptocurrency for two reasons. Firstly, it is an effective bait because cryptocurrency is often connected with high profits, and most people have only vague ideas about how investment in digital currencies works. Secondly, as blockchain-based digital currencies lack regulations and are hard to track, they make it easy for fraudsters to deceive victims, cover up the money trail, and disappear without a trace.

- Word-of-mouth information only. To evoke a sense of uniqueness and a once-in-a-lifetime opportunity, scammers often give out information about the investment only through one-to-one communication. They also fail to provide a prospectus or any form of written details about the risks and procedures of the investment.

- Offshore operations. Many fraudulent investment schemes have offshore headquarters, which makes them legally inapproachable by both regulators and deceived investors.

- Influencer endorsement. Many investment fraudsters use false authority to increase people’s confidence in an investment. However, the involvement of celebrities, well-known investors, or financial influencers is a scam, often carried out through deepfakes. Investors, deceived by the patronage of a person they know (either personally or through the media) are then more likely to lose their guard.

How do investment scams work?

How is it that scammers are increasingly successful in deceiving people with non-existent or worthless investments? Fraudsters exploit external factors such as cost-of-living pressures and the growing internet population while refining their sophistication. It’s not always the “get rich quick” ad popping up on social media.

Advanced investment fraudsters meticulously select their victims, often targeting young people or the affluent. For example, a survey conducted by Saltus revealed that, among 2,000 wealthy respondents, 41% had fallen victim to financial crime, with 20% losing money to investment scams. Supporting this, Barclays data indicates that 26% of investment scam victims are under 30.

To trick even tech-savvy consumers, fraudsters employ precise and intentional social engineering supported by advanced technology to maximize credibility. They maintain professional-looking websites and emails, deploy a network of consultants, and initially avoid pressuring their victims into making investments. This approach leads victims to willingly cooperate with the fraudsters, paying them money for months before realizing they have been conned.

JuicyFields investment scam case

The JuicyFields investment scam case recently uncovered by Europol is a typical example of both the modus operandi of investment fraud and the extensive damage it can cause. It therefore serves as a fitting example of the typical tactics used by fraudsters:

- An investment opportunity exploiting a topical issue: Criminal networks are very good at adapting to trending topics to increase the credibility and attractiveness of the advertised investment. In the case of the JuicyFields scam, the fraudsters exploited the legalization of medical cannabis—an important subject of public debate in the EU—to create the impression of a unique opportunity with low risk and guaranteed high profit and then lured the victims using social media advertising.

- Low entry barriers and minimal information: Deceived investors had to make a minimum investment of 50 euros in the so-called “e-growing” opportunity. Subsequently, the scammers promised them links to medical cannabis producers and ultimately high profits from the sale of marijuana to authorized buyers. However, the investors had no further information about how the investment worked and how it would generate high returns (up to 100 percent or more annually), let alone guarantee them.

- Building a credible image: Since this scam operated as a classic Ponzi scheme, it was initially able to gain trust by using money from new investors to pay off previous ones. The initial profits then motivated victims to increase their investments. Trust was also supported by the professional image of the company, which showcased its offices, representatives, and presence at industry events.

- Scale: From early 2020, the company managed to attract more than half a million investors worldwide, with the majority coming from Europe. About 186,000 participants transferred their money to the Ponzi scheme. In June 2022, JuicyFields abruptly shut down its social media accounts and prevented user logins. According to judicial estimates, the total damages amount to a massive €645 million. However, the unreported losses could be far higher.

- Transnational criminal network: The suspects include individuals of Russian, Dutch, German, Italian, Latvian, Maltese, Polish, Jordanian, American, and Venezuelan nationality.

AI-driven investment scams

The sophistication of investment scams significantly increases when fraudsters incorporate AI, as generative AI technologies can create convincing messages or websites in seconds. Consequently, the presence of language deficiencies, once an easily spotted indicator of potential scams, has been diminished.

Additionally, scammers use AI to generate face-swapped deepfakes of financial authorities – from business celebrities to journalists – which are convincingly used in promotional videos to lure investors into fraudulent schemes.

Last but not least, scammers exploit the current buzz around AI to attract victims. Artificial intelligence is touted as offering high returns, thus becoming part of a broader category of “guaranteed” investments that include cryptocurrencies, overseas land, and green energy projects.

Investment scams: Trends and ThreatMark data

Our Behavioral Intelligence Platform collects data real-time, monitoring signals of both genuine and illegitimate users, analyzing and interpretating the behaviors and actions of users to identify potential fraud.

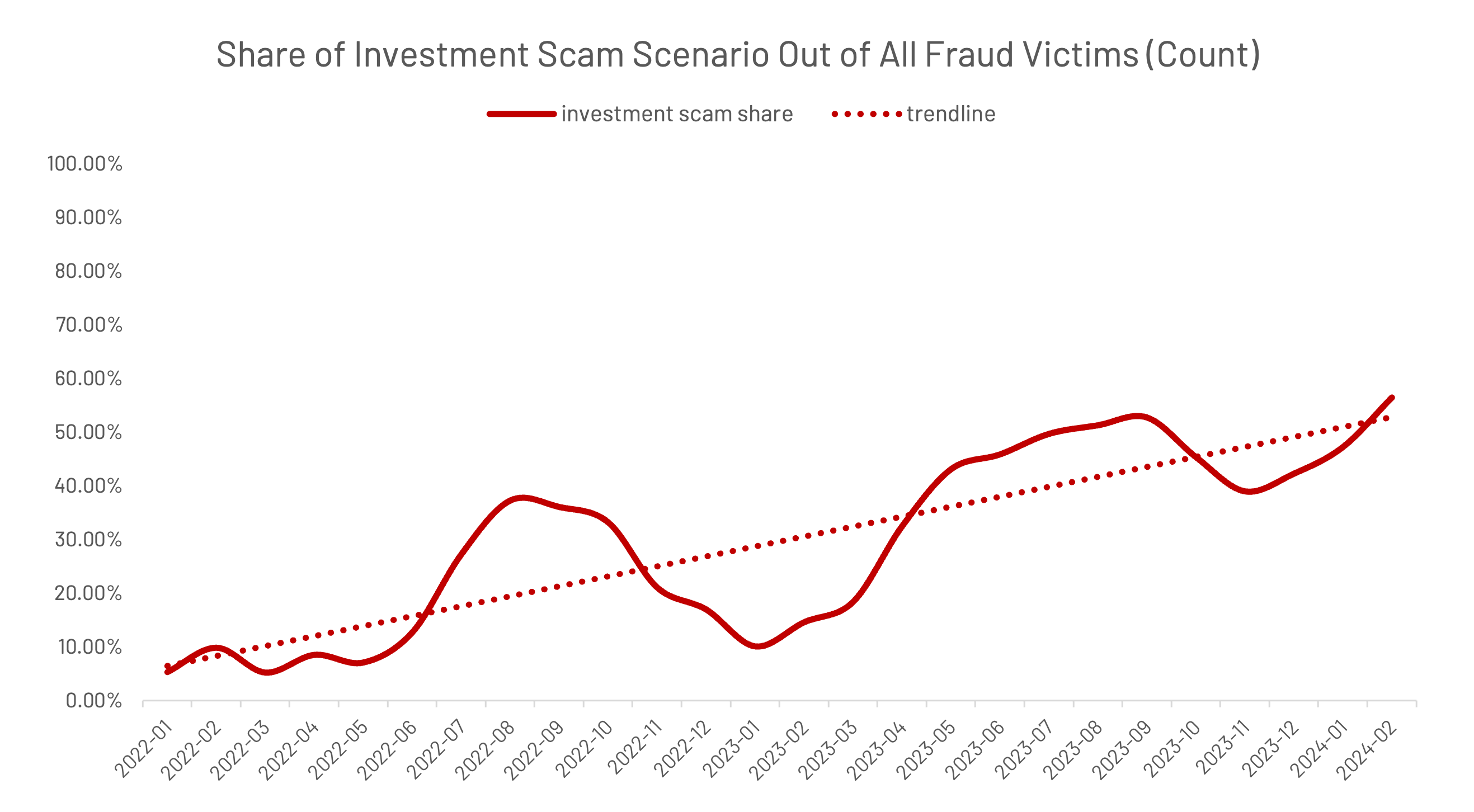

The Platform started detecting an uptick in investment scams in mid–2022 and the total number has been growing ever since. By the second half of 2023, we observed a 26-fold increase in the monthly incidence of investment fraud compared to the start of 2022. Similarly, the proportion of investment scams within the overall fraud landscape expanded by 4.5-fold during this period.

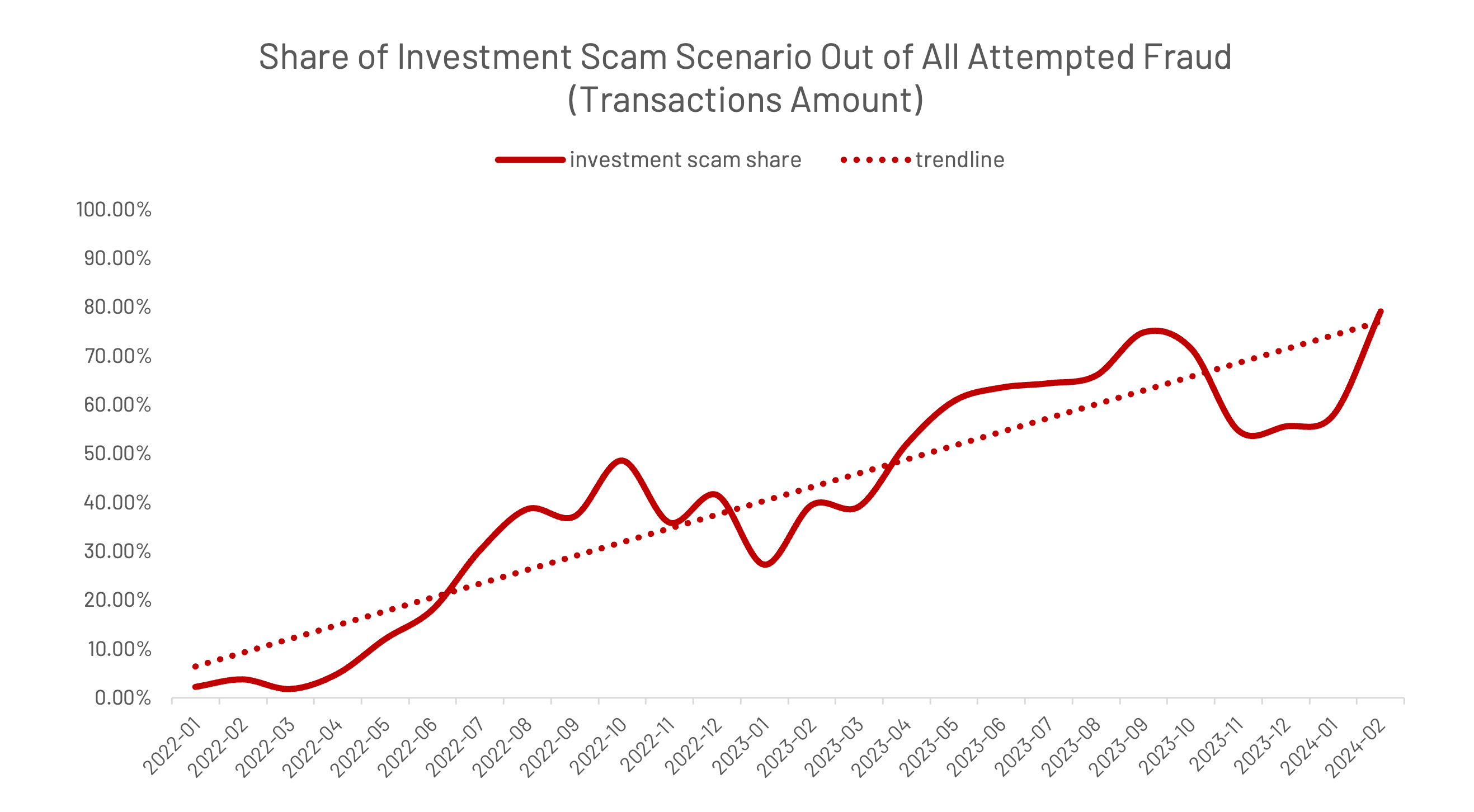

Similarly in terms of monetary losses, from 2022, a year when investment fraud levels were comparatively low, to the second half of 2023, we have observed a 40-fold increase in the monthly volume of attempted fraudulent transactions related to investment scams.

The trends in ThreatMark’s behavioral intelligence data show that the increase in investment fraud attempts will continue throughout 2024 if we do not organize our efforts to combat this aggressive fraud.

Combating investment scams with modern fraud prevention tools

In the fast-paced landscape of modern tools like AI and deepfakes, fraudsters are continuously gaining an edge over unsuspecting victims. Effectively preventing these evolving social engineering techniques requires financial institutions to operate with the same level of adaptability as criminal organizations.

Some regions are already meeting this challenge head-on. Take the Czech Republic, for example. Threatmark supports nearly 75% of banks in their fight against fraud, leveraging data analytics, machine learning algorithms, and artificial intelligence to monitor and evaluate how users interact with digital banking systems in real-time. And the results speak for themselves.

Fraud attacks on Czech banking customers tripled in 2023 compared to 2022. Yet, the average financial damage per fraudulent transaction decreased, and the total amount of money saved significantly outweighed the losses, which amounted to CZK 1.35 billion.

Here, increased efforts by fraudsters and a surge in fraud attempts have been mitigated through modern technologies that enable the swift identification and prevention of suspicious transactions – before they can inflict further harm.

How to prevent investment scams

Serving customers throughout Europe, North America and the rest of the globe, ThreatMark’s Behavioral Intelligence Platform protects banking customers from a diverse array of frauds including account takeover, RAT attacks, phishing, and particularly relevant to investment scams, authorized-push payment (APP) fraud.

The platform monitors and analyzes a broad spectrum of data from various sources, ranging from digital channel behavior and user-device interactions to device specifics and external threats. As a result, it can detect suspicious behaviors or unusual transactions early, thwarting social engineering attempts and other actions influenced by scammers.

Ultimately, ThreatMark fundamentally strengthens defenses against fraud, reduces false positives of existing fraud controls, lowers operational costs, and aids financial institutions in safeguarding the trust and financial security of their customers.